What is the GPCI-Financial Centers

With the rapid expansion and internationalization of the financial industry, competition between cities has intensified, and the importance of implementing measures to maintain or enhance their status as financial centers has grown significantly. Therefore, in the Global Power City Index - Financial Centers (GPCI-Financial Centers), we evaluate the competitiveness of cities as international financial centers from a multifaceted perspective by adding “Finance” function to the six functions of the Global Power City Index (Economy, Research and Development, Cultural Interaction, Livability, Environment, and Accessibility). This allows us to uncover the characteristics, strengths, and weaknesses of each city as a financial center within the global financial system and rank them. We hope that GPCI-Financial Centers will be utilized as an important tool by professionals in the financial industry, policymakers, and investors.

Target Cities

Executive Summary

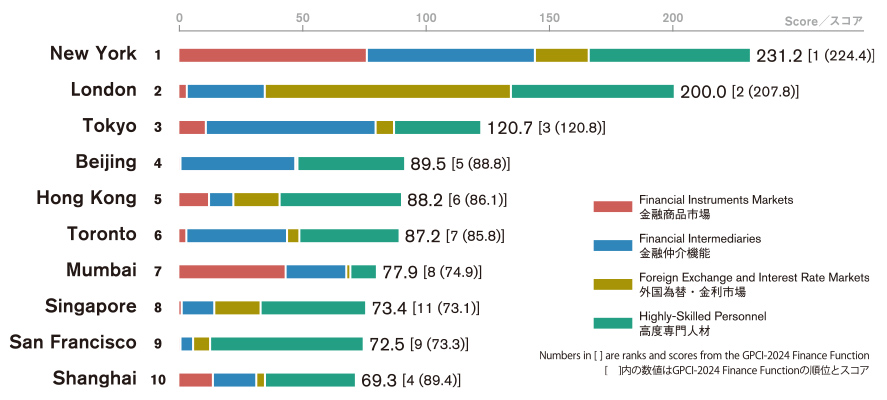

Finance Function Ranking

Comprehensive Ranking (GPCI-2025 + Finance Function)

New York secured #1 in four indicators: Stock Market Capitalization, Stock Market Trading Value, World’s Top Asset Managers, and International Law Firm Offices, and also newly achieved the top position in Capital Raised through IPO.

London maintained its top position in both Foreign Exchange Turnover and Interest Rate Derivatives Turnover within “Foreign Exchange and Interest Rate Markets,” just as last year, and further achieved #1 in “Highly-Skilled Personnel.”

Tokyo maintained its #1 ranking in the two indicators World’s Top Insurance Company Headquarters and World’s Top Pension Funds for the third consecutive year. Its rank in “Highly-Skilled Personnel” also improved from #21 to #19.

Contact

If you have any questions about the GPCI-2025 Financial Centers, please contact iusall@mori-m-foundation.or.jp

Show all rankings

Show all rankings